A primary evaluation of your own financial condition in accordance with the investigation you give a loan provider is called pre-qualification

发布时间:2024-10-21来源:家德乐淋浴房

Financial PRE-Certification And you may PRE-Acceptance

Pre-approval and you may pre-qualification are a couple of very important basic stages in the home to order techniques when it comes to providing a home loan. Despite the fact that voice comparable, he has got additional attributes and provide useful information in order to prospective homeowners. To raised understand pre-acceptance and you can pre-degree and exactly how they may help you on your journey to homeownership, we've responded some faq's about them inside website post.

What is the Difference in A PRE-Acceptance And PRE-Degree To possess A home loan?

It aids in estimating how much cash you're able to obtain. Pre-degree will not entail a mindful study of your credit report otherwise an entire look at of the financial suggestions. It gives a broad feeling of your loan qualification and you will helps you carry out a resources to possess home search.

Pre-approval, on top of that, are an even more in-breadth processes. It involves an evaluation of your own credit history, earnings, and possessions. Through the pre-approval, the bank analysis debt data files and runs a credit score assessment to search for the restriction amount borrowed you can be eligible for. A home loan pre-acceptance letter deal more excess weight and you can demonstrates to manufacturers that you is a serious and you may licensed consumer.

Why is A home loan PRE-Acceptance Extremely important?

There are many advantageous assets to with an excellent pre-approval when purchasing property. Which have an effective pre-approval, you are pre-acknowledged getting a certain loan amount. So it saves some time and allows you to desire your research toward home inside your budget.

Your honesty once the a purchaser is even enhanced because of the good pre-acceptance letter. Their bid is more more likely taken seriously and you will popular because of the providers than those from other people who have not been pre-approved. In the a competitive market, it offers an advantage.

Pre-acceptance necessitates reveal study of your finances, which makes listed here financing approval techniques speedier. An excellent pre-approval letter form the bank has complete many the fresh new documentation and you will verifications, hastening the borrowed funds closing techniques.

The length of time Do An excellent PRE-Approval Otherwise A beneficial PRE-Qualification Last for A mortgage lender?

Pre-qualification and you will pre-approval normally have a shelf life of sixty to help you ninety days. It's important to realize that while in the this time around, debt position you may transform, which could have an impact on the past mortgage recognition. Update your financial when the you can find good alter with the economic visualize, including a decline in your credit rating, a fall in your revenue, or a rise in your month-to-month debt obligations.

Really does An effective PRE-Acceptance Verify A home loan?

The truth that you have a good pre-acceptance isn't the identical to an approval for your mortgage. Instead, its a short investigations of creditworthiness according to the picture at that point over time. The last mortgage approval is contingent upon your house appraisal, a concept lookup, and additional underwriting requirements. For as long as there aren't any tall alter for the economic situation, pre-approval somewhat increases the likelihood of bringing home financing.

Should i Score PRE-Licensed Or PRE-Acknowledged First Getting A home loan?

It is normally told to start with pre-degree and you can move to pre-recognition upcoming. Pre-certification helps with the creation of a practical finances giving your which have a primary grasp of your own credit effectiveness. Pre-recognition provides an even more real research of your own qualifications and you can improves your position since a life threatening visitors and if you might be willing to follow homeownership surely.

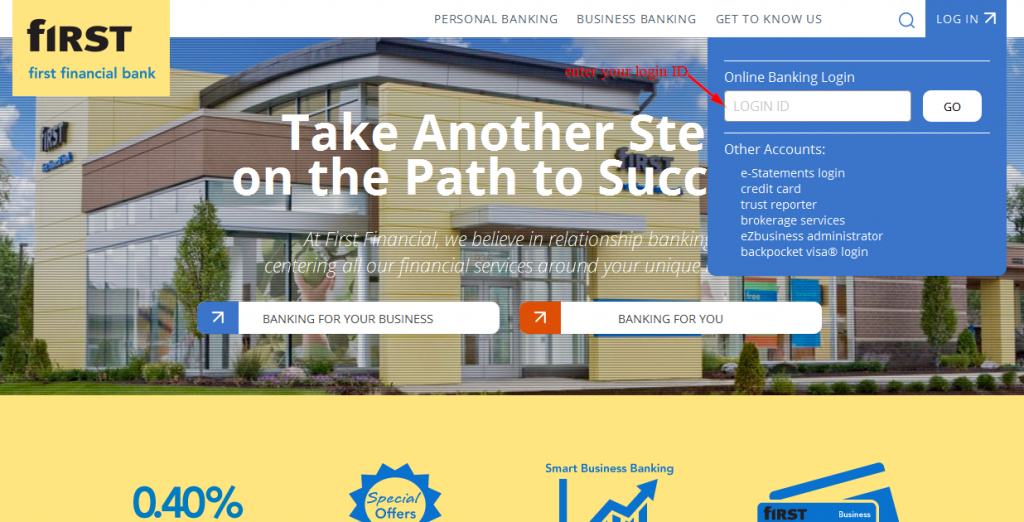

Pre-certification and pre-approval are essential stages regarding the financial processes https://availableloan.net/installment-loans-ne/. They boost their negotiation power, bring important information concerning your credit ability, and speed up the loan recognition procedure. For more than ninety ages, the experts at the Basic Mortgage (NMLS#:44912) was enabling home buyers making use of their pre-degree and you will pre-recognition demands. Also, Fundamental Mortgage keeps and you can qualities all their loans, so that you provides a partner along the lifetime of your own financial.