The way to get property Update Mortgage having Poor credit

发布时间:2024-11-15来源:家德乐淋浴房

Which have poor credit helps make numerous things harder to you. not, a lot of us has experienced a less than perfect credit score in the one point, and sometimes it can be unavoidable. When you yourself have bad credit, you are aware one installment loan New York to lifestyle continues to have to go on, even when it causes some extra challenges to you. This is some thing you might be discussing when you're a citizen looking for a house improve loan. Of several residents want a property improvement financing to invest in their residence update systems, however, that it usually requires certain credit ratings.

Government Do-it-yourself Funds

Regulators funds are going to be a good selection for homeowners that have less than perfect credit. Loans having renovations from the government tend to have significantly more everyday regulations with regards to the credit you prefer, so this is something you should bear in mind. However, of many authorities home improvement loans are extremely particular on who will get all of them, while they manage promote loans for several points. Instance, you might be capable of getting authorities let if you reside from inside the an outlying area consequently they are remodeling your home, that may help if you are searching getting offers getting roof resolve.

Domestic Guarantee Fund

When you have plenty of guarantee in your home but don't have good credit for many particular finance, a home collateral loan can assist. Taking a property collateral mortgage is going to be much easier than just delivering most other sort of fund that have poor credit since your residence's equity try put given that collateral. This will make loan providers be more comfortable loaning you currency, though your credit score actually great. If you've oriented numerous collateral of your house, you can also find a significant-sized financing, which can only help make huge ideas it is possible to. As long as you know that you'll be able to remain up with this new monthly payments, a house collateral loan shall be an effective option.

Domestic Equity Lines of credit

A house security credit line is much like a home security financing in this it spends your residence because collateral. Yet not, house guarantee credit lines operate a lot more like credit cards in the place of property equity loan. While domestic guarantee money present one lump sum matter to suit your endeavor, a great HELOC makes you withdraw the money as you need it more a flat timeframe. An excellent HELOC could be more very theraputic for residents who'll you desire money over time for their endeavor and you will are not yes just how much they're going to end up trying to find. Like that, you may not have to worry about more otherwise underestimating the purchase price of your enterprise being committed to a quantity in the event the you're not knowing about this. If you need help with something similar to plastic siding financial support and you will know the exact count ahead, a home security mortgage will be a better alternatives.

Make an application for a consumer loan

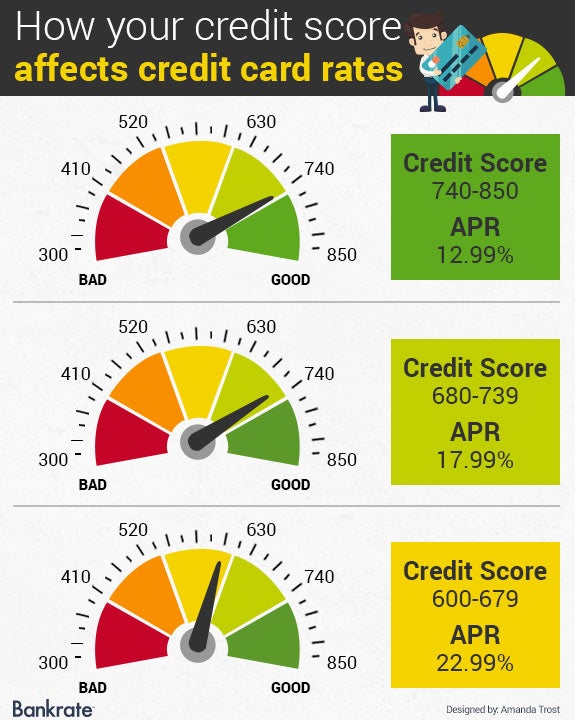

You may still be capable of geting certain fees money, such as for instance unsecured loans, even if you possess bad credit. This type of financing are used for everything you you want, causing them to a good idea for those considered do it yourself methods. You need the borrowed funds to pay for anything you must over any project. not, like most mortgage you have made having less than perfect credit, could result in spending large interest levels getting an individual financing. Obtaining an unsecured loan having a great co-signer could also leave you a much better danger of getting one and having best interest rates than using alone. Definitely, whenever you hold back until your credit score advances, you'll have an easy date providing financing, but that's not necessarily an alternative.

See what Selection You may have having Do-it-yourself Funds Now

When you yourself have less than perfect credit, shopping for a great home improvement financing could well be tough into the your own. Home improvement finance for poor credit come, you could potentially only need let interested in them. During the Homeowner Resource, we realize what choices are available for individuals with all types of credit scores, and you can all of us has experience providing homeowners discover just what they need. Homeowner Investment are an enthusiastic NRIA org, and in addition we helps you find money choice that may be difficult to get your self. We'll mention your role and you can just what investment you really have desired to find out how we are able to help make your project possible.