Discover Rates of interest and you can Monthly payments of these Financing

发布时间:2024-10-27来源:家德乐淋浴房

The fresh 29-12 months, fixed-speed mortgage is considered the most preferred financial on the You.S. Considering Freddie Mac, nearly 90% off Western homeowners has actually a 30-season, fixed-speed mortgage. Yet not, even though the new 31-season mortgage are prominent does not always mean it usually is the fresh new proper one for you!

Let us mention fifteen-seasons rather than 29-season mortgages, and exactly how they may be able change the sized your payment per month, plus the level of desire it is possible to shell out over the longevity of the loan.

Precisely what does an effective 15-Year or 30-Year Home loan Suggest?

15-12 months and you can 29-seasons mortgage loans consider the new loan's term-which is, the amount of age description you'll have to pay the cash you've borrowed to invest in your home. If you take out good 15-season financing, the loan have to be paid off during a period of 15 years. If you have a 30-12 months financing, you'll need to repay it over a period of three decades. You will also need to pay most of the interest your debt by the conclusion the newest loan's term.

Which are the Great things about a fifteen-Season Home loan?

A good fifteen-season financial has many masters. 15-season mortgages normally have lower interest rates that assist it can save you money on desire by paying regarding your mortgage faster. You could essentially build your home's guarantee faster and you will pay-off your financial more easily with a 15-12 months financing, also.

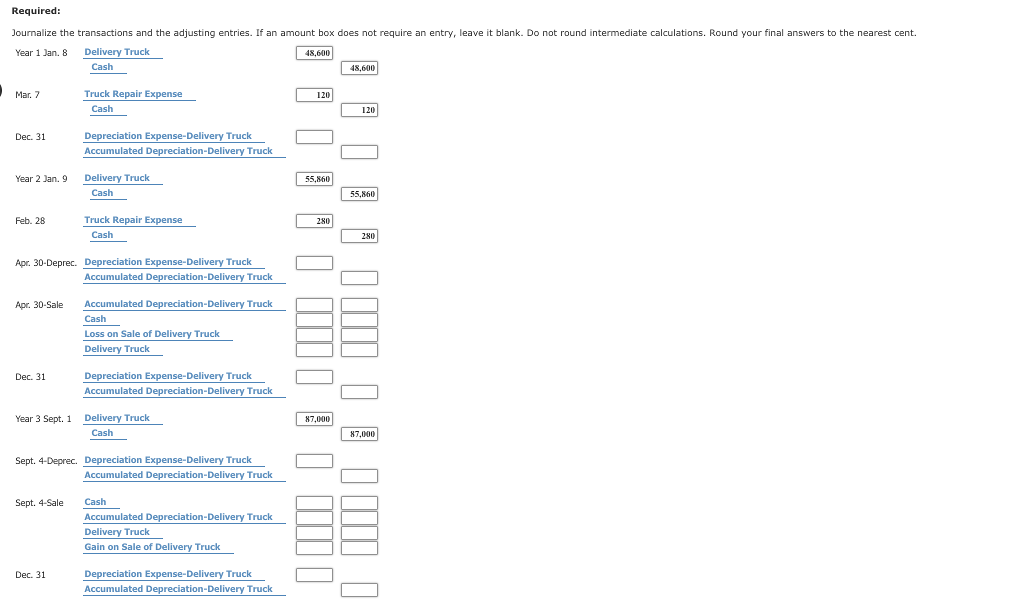

The fresh new drawback of fifteen-season mortgages is that they usually come with a high lowest payment per month. You might be needed to spend way more every month which have a 15-season home loan than simply you may be needed to spend which have a beneficial 30-12 months home loan to have credit a similar sum of money. (The amount of money you acquire is sometimes called the home loan dominating.) Examine these sample data:

Perhaps you have realized on these instances, the new fifteen-seasons financial you are going to help save you over $40,000 in the appeal costs but require you to pay more each week. Below are a few all of our fifteen- against. 30-12 months Financial Calculator so you can modify their quotes to have appeal and monthly costs.

Which are the Advantages of a 30-Season Home loan?

The primary advantageous asset of a thirty-year home loan 's the all the way down minimal monthly payment these fund want. As you care able to see regarding the analogy significantly more than, the fresh 31-season financial need you to shell out a small over $900 reduced per month, compared to 15-12 months home loan. This will generate to find a property less costly and provide you with way more independency on your month-to-month plan for other debts and costs.

Because of it lower monthly payment, you'll usually shell out a high interest and you may pay much more money in notice across the longevity of the borrowed funds than simply your manage having an effective 15-season home loan.

Can you Build Even more Repayments towards the a 30-Season Mortgage?

Sure. Really loan providers makes it possible to pay them so much more per month versus minimum necessary. This means that you can purchase a 30-year home loan but pay it off as if it absolutely was a 15-seasons financial. The main benefit of this really is flexibility. You might shell out $600 a lot more one month, $300 most the next day, and absolutely nothing extra the 3rd day.

Of numerous home owners including the comfort out-of once you understand he's the option of paying alot more per month or not, in lieu of becoming secured on always making the highest percentage. Less commission can also be exit extra cash in your plan for other costs, help save you having crisis expenditures for example an unexpected household fix, help save you to have college otherwise retirement, and a lot more.

You'll typically pay more cash inside the desire through a lot more costs with the a 30-12 months mortgage than by getting a beneficial 15-12 months home loan however, the individuals more home loan repayments will nonetheless help you save money in attract!

Could you Refinance a 30-Seasons Financial with the an excellent fifteen-12 months Mortgage?

Yes. You can usually like a beneficial fifteen-12 months financial title when you re-finance. Property owners have a tendency to re-finance out of a thirty-seasons so you can an effective 15-seasons financing whenever their incomes have remaining right up, and the highest minimal monthly premiums be a little more sensible. You can always create most mortgage payments to the fifteen-season mortgage loans, also.

Try a good fifteen-Season or 31-Year Financial Good for you?

You need to glance at the big picture of your money, together with your mortgage repayment, most other bills, expenditures, deals, and you can month-to-month income when you're deciding between an effective fifteen-season and 31-season mortgage. Particularly, think about whether a lesser monthly payment or saving money for the attract through the years is much more important to you nowadays.

Liberty Mortgage is not a monetary mentor. The latest records in depth more than was to possess informational purposes just as they are not investment or economic advice. Consult an economic coach before making very important private financial choices, and you will request a taxation coach getting information regarding the brand new deductibility away from attract and you can costs.