Bad credit Get Loan Options for Homebuyers

发布时间:2024-10-25来源:家德乐淋浴房

For those who have a reduced credit rating, the idea of to order a house would be overwhelming. Yet not, it is essential to remember that there are available options to simply help you get property, eg poor credit mortgage brokers. With the best suggestions and you can info, it's still totally possible and then make your perfect out of purchasing an effective household a real possibility.

In terms of securing home financing, it is essential to understand that your financial fitness is state-of-the-art and you will multifaceted, and should not be fully captured from the a straightforward about three-finger number. If you are loan providers think about your credit score an essential foundation, it's not the only person.

When you yourself have bad credit, it is sheer feeling worried about your odds of being qualified getting home financing. Although not, you should remember that only a few poor credit is done equivalent. Particularly, if your lowest credit rating is due to a-one-big date medical crisis, loan providers get examine your role in another way than just if you have a great history of overlooked costs otherwise non-payments.

- Exactly how much available for you for a downpayment

- The debt-to-money (DTI) proportion

- Your a position history

- Their payment background

Therefore, when you yourself have a reduced-than-finest credit rating, you should never end up being discouraged because there may still end up being available options getting protecting a mortgage.

The new copy plan: Fixing your own get after which refinancing

If you are considering getting a bad credit mortgage, it is vital to know that you may have to pay a top month-to-month mortgage payment due to highest interest rates. However, remember that to shop for a home which have bad credit does not suggest you may be trapped with our terms and conditions permanently. You can always take the appropriate steps to repair your credit through the years and re-finance your home loan getting much better mortgage words later on.

What exactly is a poor credit get?

You will find about three biggest credit agencies - Equifax, TransUnion, and Experian - and you will several kind of fico scores. Although not, 90% of the market leading lenders fool around with FICO Ratings.

The base FICO credit scores vary from three hundred so you can 850, with the average score on the U.S. obtaining during the 714. The following is a look at the categories regarding FICO Scores:

- Poor: 300-579

- Fair: 580-669

- Good: 670-739

- Decent: 740-799

- Exceptional: 800-850

If you find yourself a FICO Score with a minimum of 670 is good, specific homeowners is also be eligible for a mortgage with a cards score only five hundred, with respect to the mortgage program.

Such five mortgage choices are designed to help individuals with reasonable credit ratings reach the homeownership desires. Conditions and you may credit history minimums vary from the program.

FHA mortgage: 500 credit rating

Backed by the new Government Property Management (FHA), FHA financing is actually a nice-looking loan selection for basic-date homeowners and you will low-borrowing from the bank individuals the help of its easy credit history conditions. You can be eligible for an FHA financing having a credit score only five hundred, nevertheless lowest down payment needed relies upon their credit get. If for example the credit rating try 580 or more, you can qualify that have step 3.5% off. In case your score was ranging from 500 and 579, you happen to be required to place 10% off.

Virtual assistant mortgage: 580 credit rating

Backed by the fresh new Company off Veterans Situations (VA), Va loans are available to experts and active-duty service users. Virtual assistant fund support 100% capital, however some loan providers may need a one-day financing payment. Whilst the Virtual assistant does not set the absolute minimum credit score needs, most lenders carry out. Loan Pronto, particularly, keeps an excellent 580 lowest credit criteria.

Fannie mae HomeReady: 620 credit history

Fannie Mae's HomeReady home loan try the lowest deposit antique financing system geared toward lower-income and you will lowest-borrowing from the bank consumers, and you will first-time otherwise repeat homebuyers. HomeReady need only step three% off and you can a great 620 credit rating.

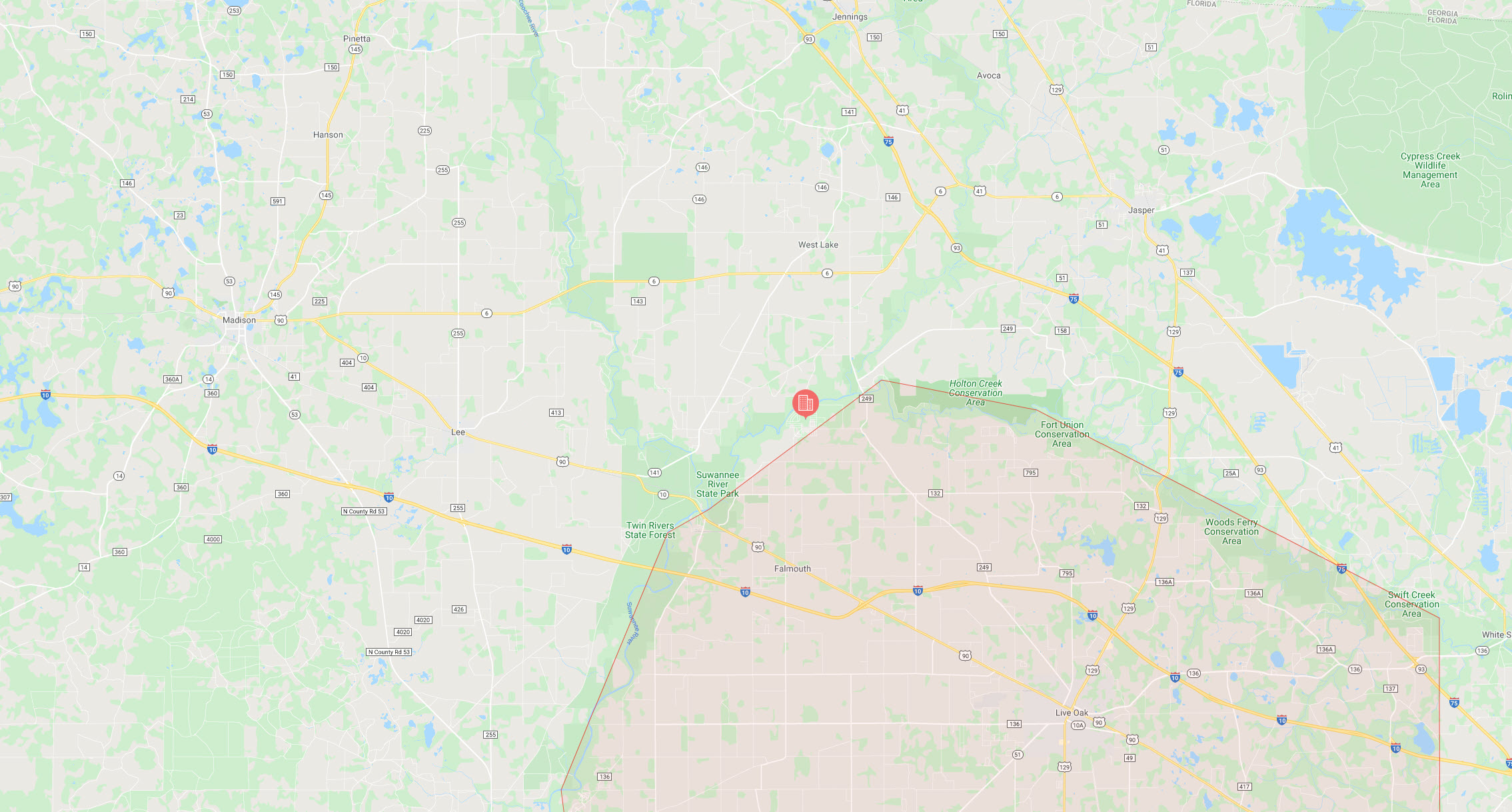

USDA loan: 640 credit history

Of these looking to buy a house in a qualifying outlying town, the new You.S. Institution from Farming (USDA) brings a beneficial $0 down-payment selection for lower- so you can moderate-earnings homebuyers. Most loan providers need a great 640 credit rating in order to qualify, along with other criteria specific so you can USDA finance.

Freddie Mac House You can easily: 660 credit score

The Freddie Mac computer Domestic You are able to mortgage is another low-down fee financing system designed for low-to reasonable-income consumers, first-time homebuyers, move-upwards individuals and you will retirees. House Possible requires good 3% downpayment and a credit score as little as 660 for buy deals.

Mortgage Pronto is here now to help with all of your mortgage need, plus house purchases and refinancing. Located a no cost rate quotation or over the online loan application to find pre-approved.

While doing so, utilize our very own free home loan and you will amortization calculators to determine their monthly percentage, along with home loan insurance coverage, taxation, attention, and a lot more.