What’s a crossbreed Financing? Listed here is In the event it Could well be sensible For you

发布时间:2025-02-04来源:家德乐淋浴房

Everyone are at the very least essentially familiar with repaired-price and you will variable-price loans available to get a property otherwise grow your company. However, a crossbreed loan? That is a hardly ever-heard-off choice. And you can yes, they generally supplies the better of both globes: The fresh predictability away from a predetermined-rates mortgage in addition to liberty from a changeable-rates financial (ARM).

Trending Hunt

In this article, we shall speak about what a crossbreed mortgage try, how it works, the fresh items offered, and-to start with-whether it might be the correct fit for your.

What is a crossbreed financing?

A hybrid mortgage starts with a fixed interest rate to possess an effective set several months-normally about three, five, seven, or even ten years-prior to switching to an adjustable rate of interest for the remainder of the borrowed funds identity. They brings together the stability off a predetermined-rates loan towards the possible gurus (and you can risks) from a changeable-speed financing.

In fixed several months, the interest rate remains regular, very you should understand exactly what your payments might possibly be every month. After that, the speed changes from time to time in line with the sector list, so that your repayments you will definitely increase otherwise fall off over the years.

Knowing the sector circumstances is key from inside the deciding whether you need to pick a hybrid mortgage. If the costs are presently reasonable and you can likely to increase, a routine financing try a far greater offer, says chartered monetary agent Expenses Ryze. not, whether your rates is actually forecast to fall, can help you best having a crossbreed financing.

What's a typical example of a crossbreed financing?

Can you imagine you're taking aside an excellent 5/1 hybrid mortgage. The fresh 5 setting you have a fixed interest rate with the earliest five many years. The latest 1 means that immediately after those people 5 years, your loan will switch to a changeable speed, additionally the interest can change annually, according to industry and lender conditions.

Style of hybrid financing

Crossbreed fund can be found in a number of varieties, based on what you need the borrowed funds to own. Why don't we explore some of the conventional ones:

1. Hybrid loans to have organization

Let the Muse match you which have a family community that meets your goals and opinions. Earliest, discover your work street:

When you're an entrepreneur, securing financial support to possess company expansion isn't any quick task. An excellent $50K crossbreed providers mortgage, such as, could give you the initial investment to grow while offering straight down, predictable payments during the fixed months. As the changeable price kicks when you look at the, you might have a far more flexible commission package, that is useful in the event your providers earnings fluctuates.

2. Hybrid financial

A crossbreed financial is the right choice when you are growing into a better financial situation. The original fixed-rate several months brings stability even though you accept into your mortgage payments. Once the financing changes to help you a changeable speed, you truly must be willing to get a higher notice if that's the case.

3. Non-PG hybrid mortgage

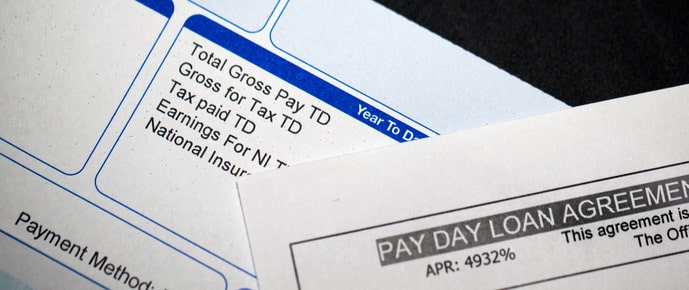

A non-privately protected mortgage, payday loans Kirk also known as non-PG, is a kind of providers loan that will not need to have the debtor to incorporate a personal make sure. When you find yourself an entrepreneur which doesn't want to put your individual assets on the line, this is a practical choice. The newest mixture of 1st repaired cost and later variable of them lets for many predictability early on if you're minimizing individual chance.

Pros and cons away from crossbreed finance

Using up a crossbreed loan boasts one another benefits and drawbacks. Let us fall apart a few of the key benefits and drawbacks:

Masters off crossbreed fund

- Down 1st rates: The newest repaired-rates several months usually includes a diminished interest rate than just a conventional fixed-price financing, and also make payments inexpensive first.