Indigenous People in the us Be unable to See Borrowing from the bank: A close Research from Local Western Home loan Credit From 2018-2021

发布时间:2024-10-18来源:家德乐淋浴房

Summation

This web site article 's the beginning of the a series that appears in the HMDA studies within the specific an easy way to cardio conversations to marginalized organizations which can be mostly omitted about national discussion to the financial credit.

- Native Americans is disproportionately underrepresented inside mortgage credit from the a very important factor away from about three. Of 2018 due to 2021, only 0.9% of all the mortgage loans personal loans for bad credit Idaho in the usa visited an indigenous American as they make up 3% of United states society.

- The tiny sliver regarding Indigenous Americans just who have the ability to purchase good house are more inclined to favor a made domestic. Local Western home loan consumers much more than simply twice as attending money a manufactured domestic due to the fact most other organizations. The long run worth of this type of home could be much less than site-based houses.

- Mortgage brokers demand large will cost you towards Native People in america than other communities regardless if he could be to shop for a cheaper home. Native People in america tend to spend a lot more in interest rates and you will closing costs getting property having quicker really worth/equity than simply borrowers from other racial groups.

Mortgage credit so you're able to Native Us americans try a significantly less than-learned point for a couple explanations. For the majority All of us ericans try a small fraction of all round populace. Mortgage loans towards the Native reservations was rare, and you will lenders during the rural components try less likely to want to be needed so you can report studies into the real estate loan applications. However, by emphasizing ericans are focused, current data has understanding of its experience with being able to access borrowing from the bank and you will building riches thanks to homeownership.

The present day financial experiences off Native Us citizens is needless to say molded of the many years regarding unlawful oppression, broken treaties to the You government, forced relocation and you can expropriation. So it black background looms from the margins of study and that employs and in and therefore we outline but that part of the fresh larger history of a great genocide .

Indigenous Us citizens nevertheless deal with significant barriers when it comes to being able to access mortgages. Centered on a diagnosis of Mortgage loan Revelation Work (HMDA) analysis, simply 0.46% of one's 42 mil mortgage loans produced in the us from 2018 to help you 2021 visited an indigenous American applicant. Certainly holder-occupied mortgages they were just 0.9% of all of the borrowers. This is dramatically reduced as compared to dos.9% of your inhabitants one to means since the Native Western by yourself or perhaps in integration together with other organizations. Thus financial credit to help you Native Us citizens would need to increase by the one thing of half dozen to achieve parity. In contrast, 14.2% out-of Us americans choose since Black colored alone or perhaps in combination along with other racing and additionally they obtained 5.6% of all of the mortgages of 2018 so you can 2021, an improvement out-of 2.5.

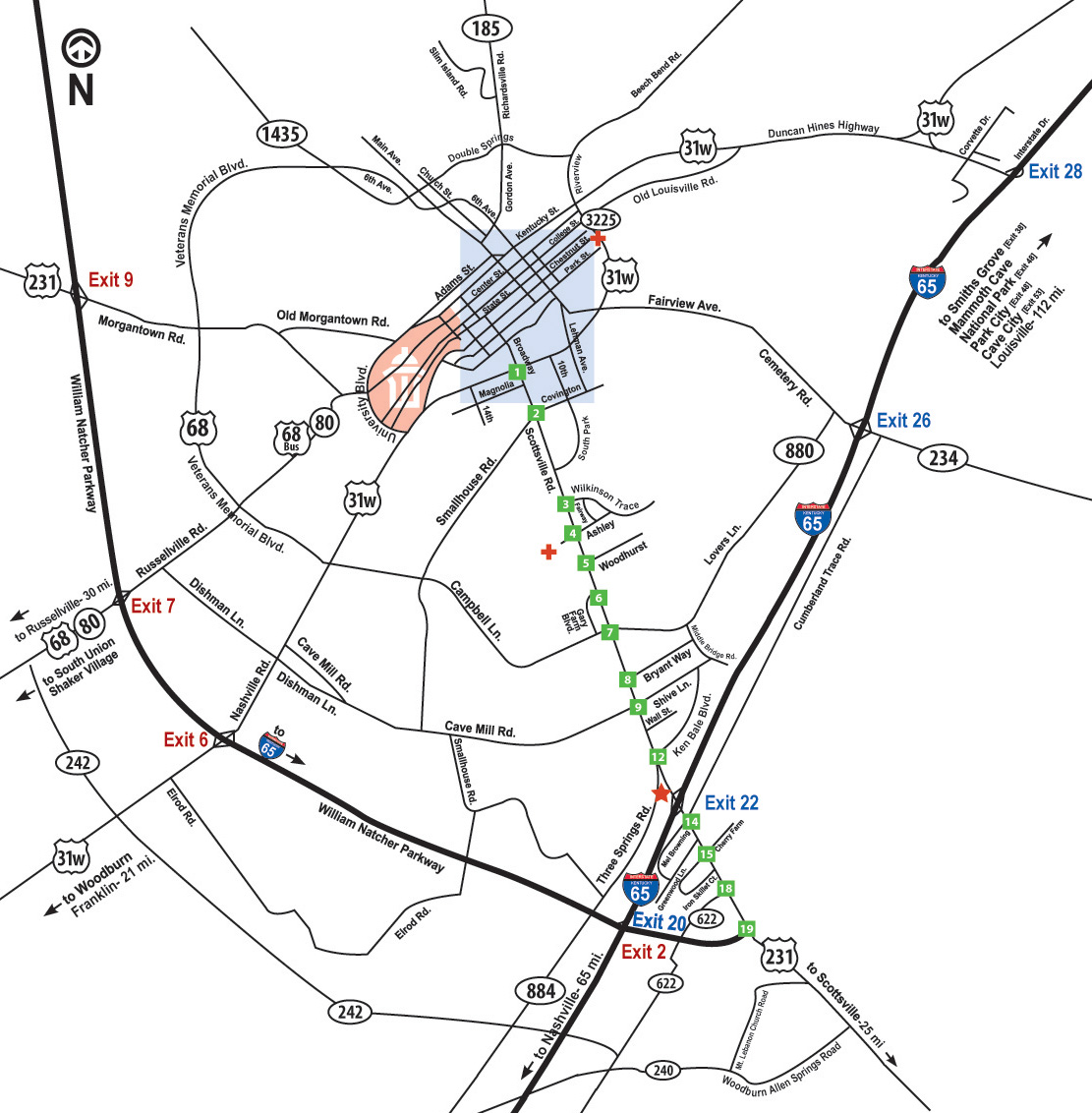

Where Try Local People in the us Taking Mortgage loans?

NCRC's investigation in addition to learned that Native Western consumers is extremely concentrated for the particular, short city elements that geographers telephone call key dependent analytical components (CBSAs). The big about three CBSAs getting Native American lending are Tahlequah, Oklahoma; Lumberton, New york; and Gallup, New Mexico. In every about three, more than 31% off borrowers was in fact Indigenous Western. Lending with the are formulated homes is apparently so much more focused, that have 68.9% from are created family consumers within the Gallup identifying because the Local Western. During the Gives, The fresh Mexico, and Lumberton, Vermont, more than forty% out-of are made family consumers was out of Indigenous Western descent.

Preciselywhat are Local Americans Investment With regards to Mortgages?

seven.9% of the many Native American homebuyers away from 2018 so you can 2021 have been funding a made family. It was more than twice compared to the consumers nationwide (dos.91%).

Light and Hispanic homeowners was indeed the next and you will 3rd probably to take out a home loan so you're able to fund the acquisition away from a manufactured home, within step 3.26% and you can step 3.25% of the many 2018 to help you 2021 family pick finance.