For many who break the regards to the loan agreement, loan providers is repossess the car without notice

发布时间:2024-12-24来源:家德乐淋浴房

Providing Help with Secured personal loans

If cannot pay monthly installments on your car otherwise family, usually do not hold back until youre already for the standard before acting. For people who get behind due to a temporary financial state and you have the money to create the mortgage most recent, get in touch with the lender in order to reinstate the borrowed funds.

In the event the vehicle is actually repossessed therefore are obligated to pay over it may be worth, a court you can expect to need you pay the essential difference between the newest car's well worth and you will your debts. To stop it, negotiate on lender when you cannot create money. Offer the vehicle your self when you can net adequate to repay the mortgage.

If not pay their mortgage, the lending company have a tendency to file a notification to help you foreclose, that may imply you you're your house that also may possibly not be value what you owe. Discuss along with your loan providers. You may be permitted to sell your property at under you borrowed from together with financial will get agree never to pursue a deficit judgment. For more information for disappointed residents, go to the government Agency away from Casing and Urban Invention webpages, .

Getting Help for Personal debt

Getting away from unsecured loan debt are going to be complicated. For people who are obligated to pay more you could pay, contact the debt owner to discuss credit card debt relief alternatives.

Basic, make an effort to organize your money to expend off your mastercard stability. Assault this new notes on the highest rates first. Slash way back on your using. If it can not work, thought a loans government program as a result of good nonprofit borrowing from the bank counseling department, that can work at creditors to minimize rates on your notes and framework an easily affordable monthly payment. This action does away with obligations over time constantly step 3-five years and needs punishment and you can relationship.

The last lodge is personal bankruptcy. It does really reduce filer's ability to borrow money inside the the years ahead, but it may be the best way aside. Bankruptcy proceeding can not release particular costs such as for example figuratively speaking and you may child assistance, so you must pay them even after your own most other costs have been removed courtesy personal bankruptcy.

How-to Pay off Obligations

When you are getting financing whether it's protected or unsecured the main thing is to make uniform, monthly obligations you to definitely put you focused to help you eliminating you to financial obligation. That is what anyone intends to manage, however, either lifestyle requires unforeseen converts, also it gets hard to do.

Both, the clear answer can be as easy as performing a funds very you can reduce so many spending so you're able to provide money to spend down the money you owe. Asking an effective nonprofit borrowing counseling institution for example InCharge Loans Possibilities to possess help with personal debt is free, and counselors can help you discover how to get regarding personal debt. One method possible solution is debt consolidating, that is specifically active having credit card debt, hence generally sells large interest rates. Combination allows you to mix multiple, high-attract expense toward one payment per month within a lower rates.

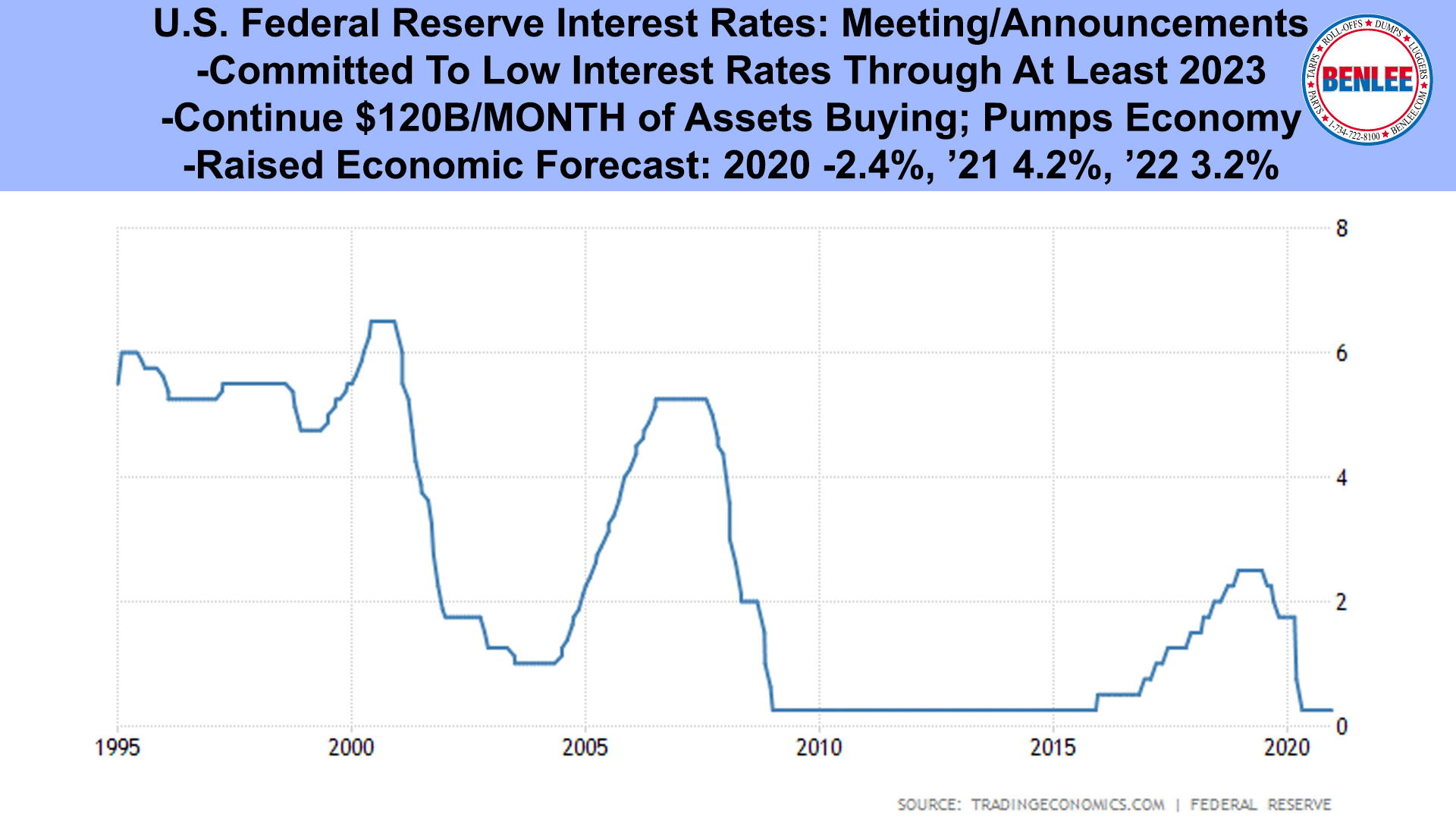

- Rates of interest are large: Interest levels into signature loans are notably highest. An average charge card interest over the past decade range away from 16-19% installment loans online in South Dakota, while payday loan will cost you 300%-500%.

So, whenever you are performing a venture where you can qualify for often types of financing, contrast the eye pricing, fees and installment laws and regulations. In the event the prices change is reasonable anywhere between covered and you will unsecured, an unsecured loan that doesn't place your assets on the line can get meet your needs. It the case in the event the credit history was higher.